FAFSA Simplification

The FAFSA Simplification Act introduces significant changes and overhaul to the processes and systems to award federal student aid. This includes the FAFSA form, need analysis, and the many policies and procedures. While some changes began during the 2021-2022 award year, the full implementation will happen during the 2024-2025 academic year. The goal of these changes will make it easier for students and families to apply for federal student aid and to help streamline the process.

- The 2024-2025 FAFSA will be available later in December 2023. The exact date to be announced. Please check back and visit our Financial Aid Announcements page for updates.

- Streamline the application process by reducing the number of questions on the FAFSA and making it easier to transfer tax information directly from the IRS

- List up to 20 colleges on your FAFSA.

- 2024-2025 FAFSA will be available in 11 languages.

- Replacing Expected Family Contribution (EFC) with the Student Aid Index (SAI). The SAI is used to determine your ability to pay for college and aid eligibility. The minimum SAI will be -1500.

- There will be changes in the methodology used to determine aid:

- Child support received will count as an asset.

- Family farms and business will count as assets.

- The number of family members in college will no longer be considered in the needs analysis formula.

- New terminology being used in the financial aid eligibility process.

- Consent and Approval: Each contributor will be required to provide consent and approval to have their federal tax information transferred from the IRS, have their tax data used to determine the student’s eligibility for aid, and allow the U.S. Department of Education to share their tax information with institutions to administer Title IV aid. The consent is necessary even if the contributor does not have an SSN, did not file taxes, or filed taxes in a foreign country.

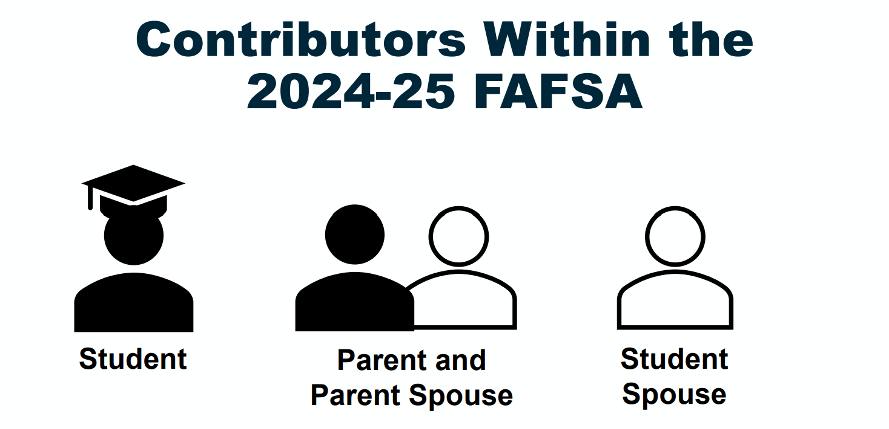

- Contributor: Anyone who is asked to provide information on the student’s FAFSA. This includes the student, student’s spouse (if applicable), biological or adoptive parent, or the spouse of the remarried parent who is on the FAFSA.

- Federal Tax Information (FTI): Rather than importing tax information from the IRS to FAFSA using the IRS Data Retrieval Tool (IRS DRT), application will provide consent to provide their FTI via a direct data share with the IRS.

- Student Aid Index (SAI): The SAI replaces what is formerly known as the Expected Family Contribution (EFC). The SAI is calculated from the information on your FAFSA to determine your family’s ability to pay for college and is used to determine aid eligibility.

- Unusual Circumstances: When a student is unable to contact a parent or contact with the parent poses physical or emotional harm to the student. Students with unusual circumstances will be given a provisional independent status and complete the FAFSA without providing parent information.

Contributor

For the 2024-2025 FAFSA, a contributor refers to anyone (student, the student’s spouse, biological or adoptive parent, or the parent’s spouse) who is required to provide information on the FAFSA. The answers to the FAFSA will determine which contributor will be required to provide their information and consent. The student or parent will invite contributor to complete their portion of the FAFSA. The contributor’s name, date of birth, SSN, and email address will be needed. If a contributor does not have an SSN, they can still be invited to complete their portion of FAFSA using alternate information.

The process for contributor to provide their information and consent:

- The contributor will receive an email informing them that they have been identified as a contributor.

- Create a StudentAid.gov account (username and password – formerly known as FSA ID) at StudentAid.gov if they do not already have one.

- Review the information about completing their section of the FAFSA; and provide the required personal information, financial information, consent, and approval on the student’s FAFSA. If the contributor does not provide consent and approval to have their FTI transferred into FAFSA, the student will not be eligible for federal student aid.

- Watch for emails from the U.S. Department of Education to ensure you don’t miss any important updates.

- Opt in to SMS (text) messages by logging in to your StudentAid.gov account to receive up-to-date notifications and information.

- Follow Federal Student Aid on X (Twitter), Instagram, and Facebook for announcement and resources.

- Ensure you and your contributor(s) have a StudentAid.gov account (username and password – formerly known as FSA ID) if you do not already have one. If you previously completed a FAFSA, you already have a StudentAid.gov account and do not need to create a new one. That is the same for your parent if they signed your FAFSA. If you are a new student completing the FAFSA for the first time for 2024-2025 or if your contributor(s) does not have a StudentAid.gov account, you may create an account on StudentAid.gov.

What does it mean to provide consent & approval?

It means you agree to the following:

- sharing personally identifiable information with the IRS

- have federal tax information transferred directly to the FAFSA via direct data exchange with the IRS

- allow the US Dept of Education (the Department) to use federal tax information to determine eligibility for federal student aid

- allow the Department of to share federal tax information with schools listed on FAFSA

How to create an account & username for StudentAid.gov

Walk through the process of creating your own Federal Student Aid (FSA) account username and password, also known as an FSA ID. Your FSA ID can be used to securely log in to U.S. Department of Education websites

Gather information required to complete the FAFSA form

If you plan to submit a 2024–25 Free Application for Federal Student Aid (FAFSA®) form, gather the required documents and information that you’ll need to fill out the form.

You’ll need your Social Security number (SSN) if you have one and your parents’ SSNs if you are a dependent student. You and your contributors will be required to provide consent and approval to have federal tax information transferred directly from the IRS into your form. If you need to manually enter information into the FAFSA form, gather tax documents and information on cash and untaxed income.